In recent years, UAE has become home to many internal businesses who have made UAE their main bases to cater services to many other countries. The business-friendly ecosystems and a robust legal system based on international standards have ensured companies can carry out their business activities with minimal issues and keep worries at bay. However, some parties dealing with the illegal trades may use the system to their advantage to launder the unaccounted money earned from gambling, drug trafficking, and other unlawful activities to clean money. Hence, the UAE auditors play a crucial role in identifying and preventing money laundering.

Money Laundering

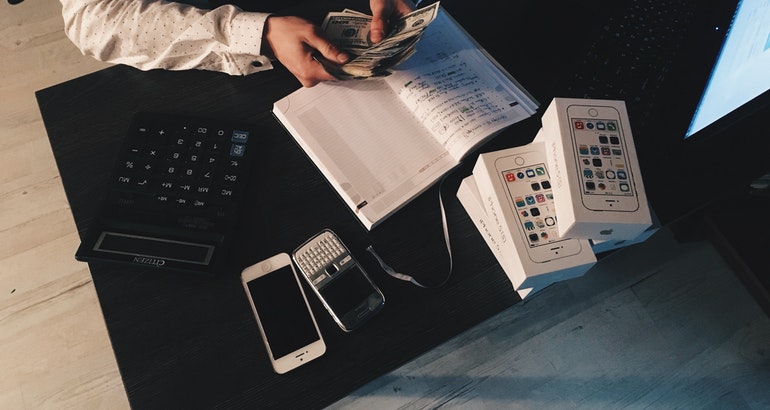

Money laundering can be defined as a process of changing vast sums of unaccounted money obtained from crimes such as theft, drug trafficking, gambling into origination from a legitimate source. It is a serious financial crime that is practiced both by white-collar and street-level criminals. Money laundering is a punishable crime in the UAE and many other locations worldwide with varying definitions.

In recent times, modern technologies like online banking and cryptocurrencies have eased transferring funds and withdrawing money without any detection. As a result, the prevention of money laundering menace has evolved into an international effort and includes terror funding as one of its targets.

Process of Money Laundering

The first stage of money laundering occurs when an individual involved in criminal activity injects the cash proceeds from the trade into the formal financial system. Layering is the second step of the process executed to make it difficult for financial authorities to trace the illegal money in the system. After moving the dirty money into the financial system, the funds will be either converted into legal monetary instruments or used to purchase assets to be monetized later to make tracing impossible. The final third stage is to retake the cleaned money back without the knowledge of the government.

Money Laundering through Shell Companies is a common technique. However, in the actual world, the Shell Company does not exist. Shell companies exist only in fake records, and no goods production or distribution will occur in such businesses.

Role Of Auditors towards Anti-Money Laundering

Under the UAE Anti-Money Laundering Law, auditors must carry out background checks of clients before any business relationship. The auditors must get information about their client’s identities and confirm using reliable, independent sources. The primary role of the financial auditors in the UAE is to prevent and combat any potential money laundering practice and improve the information credibility from the financial statement.

DFSA (Dubai Financial Services Authority) is one of Dubai’s International Standards Financial regulators who aims to promote transparency and efficiency of financial services, regulate financial institutions, increase trust & confidence in the financial service industry, and prevent money laundering. Many companies face strict regulatory risks for any Anti-money laundering non-compliance. Under the new Anti-Money Laundering Law in UAE, the corporate liability for proven money laundering crimes extended to fines of up to AED 50,000,000 and mandatory liquidation for all offenses about terror financing.

Risk Identification and Assessment for Auditors

UAE Anti Money Laundering Law requires the Audit professionals operating in the UAE to identify and assess the Money Laundering risks while carrying out their duties. Under the UAE Anti-money laundering law, the Audit professionals are required to approach risk assessment in following perspectives- first, the Auditors must identify and assess their own money laundering risk based on the nature and type of their clients, and second, the Auditor’s responsibility to identify and evaluate the client’s money laundering risks whenever employed to check the same by the client. Additionally, auditors should consider potential risks from factors such as geographic, consumer, product & services risks, delivery channel, etc., during their risk identification and assessment.

Customer Due Diligence

Under the UAE Anti-Money Laundering Law, audit professionals must carry out necessary background checks before onboarding their customers. Auditors must obtain information about clients’ identities and verify the information accordingly. Auditors should have a procedure to screen their clients, inclusive of their actual beneficial owners and managements against UN Sanctions Lists.

Report Suspicious Transactions Under Anti -Money Laundering Law

Audit professionals must report any suspicious transactions to the UAE Federal Intelligence Unit (FIU). Under the Anti-Money Laundering Law, Auditors must immediately report all transactions deemed suspicious to the authority. In addition, auditors should put in place a system of indicators to help detect suspicious transactions.

Further, the auditors operating in the UAE are mandated to register with the goAML portal. The goal is the security medium through which the Auditors can submit any found suspicious transaction reports to a government agency.

Appoint a Compliance Officer under Anti- Money Laundering Law

Under the UAE law, Audit companies must appoint a compliance officer who shall be duly qualified and competent to conduct the role of compliance officer as stated under the UAE Anti – Money Laundering Law.

How Can We Help?

Jaxa Chartered Accountants are one of the well-known auditing companies in the UAE. Our offices across most of UAE Emirates assist our clients in matters related to accounting, auditing, and UAE anti-money laundering law. Please Contact Us with any questions related to anti-money laundering in the UAE. We’d be happy to help you!

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.