Is Your Company Registered Under Tax Grouping?

On 1st Jan 2018, the United Arab Emirates (UAE) came up with the implementation of tax for GCC countries with a rate of 5%. The nation was well known for tax free zones, but this initiative has been taken forward with an idea to generate a different source for income and to leverage the nation’s GDP. Since, the nation was an attracting ground for budding entrepreneurs and businesspersons, reason being it was tax-free, the VAT implementation turned out to be a matter of concern. To ease the process for existing as well as new companies, the Government of UAE came up with the idea of TAX/VAT grouping. Now, you must be wondering what Tax Grouping is all about? Well, this article will give your answer. Apart from that you will get a clear idea as to how it can benefit your company in a long run. Let’s start.

What Is Tax Grouping?

The UAE provides an option to business entities where-in two or more companies can collaborate together and fall under the same tax group. These entities need to get themselves registered under UAE Federal Tax Authority (UAE FTA) as a single subject to be taxed. It is to be noted that the group formation takes place exclusively for tax.

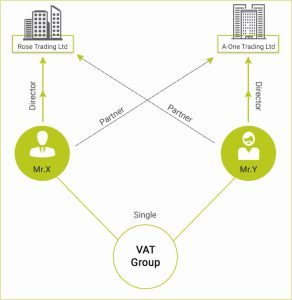

As per the Federal Decree Law Number 8 of 2017, VAT /TAX Group is defined as- “Two or more persons registered with the authority for Tax purposes as a single taxable person in accordance with the provisions of this Decree-Law”. To understand how tax group is formed, have a look at the illustration below:

We can say that it turns out easier for companies once they form a Tax Group. Now, let’s understand the essentials required for applying VAT Group Registration. It is to be noted that a certain sum is to be provided for the registration process.

- For Mandatory Registration- AED 375,000

- For Voluntary Registration- AED 187,500

Who can Apply for Tax Group?

The UAE has given to business entities to form Tax Group to both established and small businesses. Different companies operating in different Emirates can fall under the same tax group. However, there arises certain basic conditions on the basis of which a company can enroll its name in a Tax Group. The conditions are:

- All the companies should have their main office and must possess business license

- They are supposed to be related parties

- There exists a flexibility where one company controls the others, or two or more persons together can control others.

The relevant parties shouldn’t be a member of any other Tax Group

Documents Required for VAT Group Registration

The documents required for VAT Group Registration involves:

- Trade License Copy

- Memorandum and Articles of Association

- Passport copy of the Manager

- Emirates ID of the Manager

- Copy of Power of Attorney (if any)

- Financial Statements of the company

- Certificate of Incorporation

- Customs Authority Registration Certificate (if any)

How to Apply for VAT Group Registration?

The procedure to apply for VAT Group can take place in two different ways:

1.Online Process

2.By Representative Member

Benefits of Tax Grouping

- All the entities are referred to as one entity

- Simplifies the accounting process

- Low risk regarding transfer pricing

- Compliance cost turns out to be cheaper

- VAT Reports are to be prepared in group

- Any transaction of goods that takes between the registered groups will not be charged

It can be seen that tax grouping is a tedious job. Handling this process in-house can lead to miscalculation and ultimately can affect your business. The best way to handle tax-grouping is to outsource it to subject-matter experts, who are well-experienced in this domain. A tax accountant can solve your issue in a much faster and easier way. Tax experts at JAXA can guide you accordingly by understanding your business requirements and by providing customized solutions. For further information, do contact us-we’d be glad to assist!