FinTech: The Future of Finance

Financial technology for short, FinTech, is one of today’s most exciting and fast-growing fields of global business. Although the term may be basic, products and companies in the banking and financial services industries that employ newly established digital and online technology are far more complicated in how it is used and its effect on customers.

In short, finance can be explained by linking it with marketing; there are factories that make goods like banks keeping interest-rate deposits, or investment managers making investment funds, or lenders and insurers underwriting certain company risk with capital. Then there are stores selling the product like bank branches, financial advisors, insurance salespeople, or lending officers. Between these two extremes are complex human value chains, balance sheets, and machines, bound together by the patterns of regulation and industry. Yet consumers visit a store at the end of the day and purchase some financial stuff.

Growth of The Finance Industry

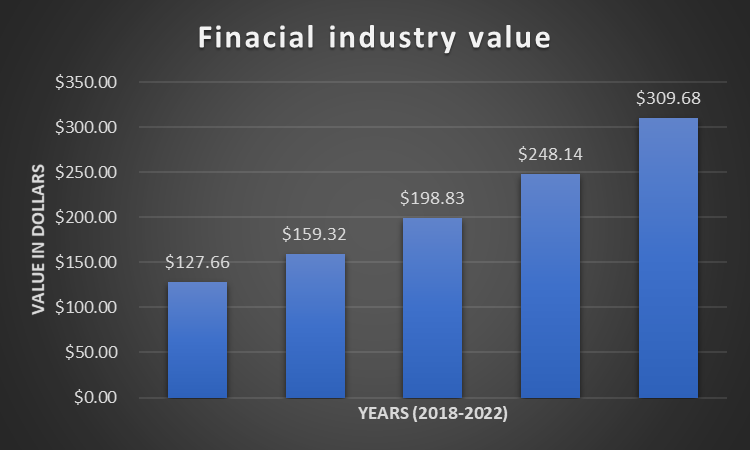

The global fintech industry in 2018 was estimated at around 127.66 billion dollars, which is projected to rise to 309.98 billion dollars by 2022 at an annual growth rate of 24.8 per cent. Growth in the digital payments industry drives the global financial technology (Fintech) market.

Fintech has made goods and services payments quicker, safer, more convenient, and more cost-effective for consumers. Customers may now pay for different products and services by cryptocurrencies, reward points, and other alternatives to digital cash. The growth in the digital commerce market and the proliferation of mobile technology has contributed to the growth of the digital payments sector. When more and more businesses are embracing digital payment systems, demand for fintech solutions is growing and driving the market growth. The value of global investment in fintech grew by 75% to $22.3 billion. The sector of financial services that saw the biggest disruption from fintech was consumer banking. This is likely because consumers are looking for new ways to transfer their money on-the-go and with as little friction as possible.

8 Major Fintech Developments

Some of the above phenomena showed significant growth and proved to be here for a few years to come.

Now let’s look at the latest trends in financial services technology.

1. Disruptive Innovations in Payments

Innovative payment systems have been replaced with physical currency, as digital wallets and contactless payment devices are the order of the day. Our vision of digital transactions is expected to transform in 2020 due to the exponential growth of cryptocurrencies, the key driver of progress in payment systems. Improvements also impacted all facets of the funding transactions.

- Sending and receiving of payments

- Technology enhancements

- Automated payment services

- Innovative user experience

- Brand new ways of FinTech collaboration

The main benefit of using cryptocurrencies and payment tokens is to step away from conventional banking and its inherent rules. Individuals and companies prefer a more egalitarian way to handle funds which have become a reality thanks to innovative payment technologies.

2. Platforms As a Service

One of FinTech’s 2020 projections is the strengthening of PaaS applications heading into the cloud. New and strong PaaS focused on cloud infrastructure technologies helps companies to extend their ready-made systems and incorporate new innovations to suit their business needs.

Conventional PaaS worked well for the FinTech industry as providers took on the job of configuring and maintaining applications that free up the time for coding tasks for developers. PaaS vendors today take much greater responsibility for providing team collaboration solutions, implementation streamlining tools, configuration services, and resource management services. With these key areas being turned over to PaaS providers, other financial-sector business processes such as budget preparation, credit risk management, payment processing, billing, and customer support will also be delegated.

The key advantages of using PaaS in the FinTech

- Fast Product Launch

- Post-Paid Service

- Adaptability

- Agile approach

- standardized middleware and database management

3. Blockchain Movement

Blockchain is no longer news in fintech. While some experts are predicting the end of the blockchain era, at the same time, some people see the innovation merely as cryptocurrencies. Only a few members are able to recognize and understand the key impact of decentralized technologies. The use of blockchain goes much further than only cryptocurrencies. It’s a flexible, innovative solution that solves the majority of modern fintech problems.

Let’s look at some examples.

⮚ Fraud Detection and Cyber Attack Prevention

Some of the Treasury Sevices uses a decentralized database to protect its customers’ personal and financial data. All information about real-time payments and profile details are stored on multiple blockchain servers, as opposed to the old-fashioned centralized system. There is no longer an open possibility of targeting a single database.

⮚ Market Research and Customer Analytics

Some of the banks use blockchain for storing KYC statements KYC stands for “Know Your Customer”. The policy on getting and storing customer data is especially strict in financial sectors each year, an average bank invests 40 million dollars per year in complying with privacy regulations. Blockchain databases correspond to governmental requirements and shorten the time, needed for data processing.

⮚ An Innovative Payment System

Blockchain can substitute traditional money transfer methods like Swift money transfers, enabling much cheaper global transactions. Just recently, we’ve seen a release of a real-time gross settlement system to ripple. The service provides the blockchain-based services of currency exchange and international payments.

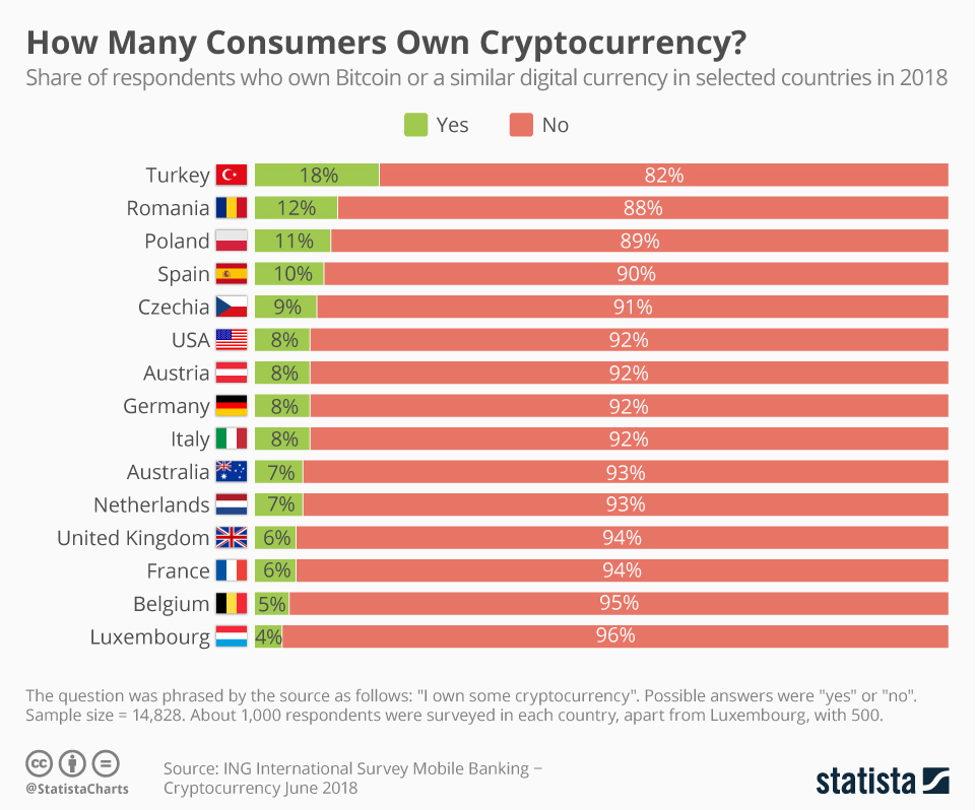

The above picture depicts information about the number of consumers using cryptocurrency in some of the countries.

4. Conversational Banking

Chatbots have been a buzzword in the industry for a while, but in 2019 we finally saw some cutting-edge developments. Conversational banking assistants were implemented by JP Morgan, Bank of America and others. The leaders of the industry set high customer standards, and fintech companies will do their best to follow.

Challenges of Conversational Banking

⮚ Understanding Customers Needs and Intentions.

Chatbots are not yet completely capable of understanding a user’s message, primarily when using a casual language. Grammatical mistakes abbreviations and Slangs stand in the way of complete comprehension between a consumer and a digital assistant. In 2020, chatbots will solve these issues in more than 25% B2B companies by providing examples, questions, clarifications, and multiple answer alternatives.

⮚ Time-Efficiency and Clarity

Even if a chatbot is capable of understanding a request, the next step is fulfilling it seamlessly. Developers are already working on adding maps, schemes, videos, and natural voice memos to their assistants.

Perhaps, by the end of 2020, the end-user wouldn’t be able to tell the difference between a chatbot and a human worker – that’s what all fintech companies should be aiming for.

⮚Secure Online Transactions and Private Data Management

Online safety depends on multiple factors – the quality of the user’s connection, the protection of the bank’s service, and country regulations. Chatbots will use a hashing mechanism – automated encryption which leaves the content entirely undisclosed even to the website’s creators. Another issue is finding the balance between PII and non-PII transaction data. Ideally, the chatbots have to be able to keep the conversation going smoothly with a minimal amount of personal data – so it won’t be used by social media websites’ targeting.

5.Total Automation

In the FinTech industry one of the latest

developments are the complete automation of the main financial processes. According to the research, “intelligent automation is a combo of continuous innovations in AI, robotics (RPA), and financial business processes automation.

Benefits of Automation

- Faster product and service delivery

- High returns

- Stronger financial health in the short and long run

- Enhanced cross-selling

- Higher customer satisfaction

Limitations of Automation

- The requisite amount of data needed for operations with AI and ML.

- Top management voicing hesitation in automating the financial system

- Difficulties in creating a detailed business case

- Lack of qualified experts and implementation tools

- Thus, not so many businesses are ready to move their operation to the automated base, which discourages other businesses from pursuing this trend.

6. Digital Banking

The new generation of digital bank institutions has made a vital difference in the financial sector over the past few years. They give more freedom, use a personalized approach, and deliver products and services at fast speeds. Some of the providing only digital banking are starling bank, Curve, Loot, and so on.

7. Advanced Credit Models

The incumbents used to apply simple social-demographic data to determine future borrowers ‘credit scores. As a result, test results came with a high likelihood of error, which affected the credit risk of the entire portfolio of loans.

The efficacy of credit risk assessment has exponentially increased with the development of alternative credit decision-making models (ACD) used by Fintech companies. ACD models are focused on the use of additional information tools such as

- Social media data to create a clearer image of a customer and to assess their behavioural preferences

- Location and transaction history to better identify the purchasing behaviours of customers

- Links to personal files offering more data on the needs and desires of clients

- Machine Learning used to develop current credit models

Machine Learning, combined with advanced data, is designed to make credit models more complex and meaningful, increase access to the credit market, and reduce default risks for loans.

8.Cyber Security

Cyber-security issues are the last factor in the collection of financial services developments. Although FinTech provides financial players with more opportunities, it also makes them more vulnerable to cyber-attacks.

The Major Security-Related Issues

- Data tampering

- The loss and theft of financial records

- Hacking into personal accounts and profiles

- Malware intrusion

- Inadequate CDD and AML checks

- The misuse of the cloud environment

It is claimed that biometric systems tackle some of these protections and privacy problems with greater efficiency. On the one hand, the advancement of biometrics greatly contributes to the prevention of fraud and money laundering. On the other hand, users consider instant authentication more useful as it removes the need to memorize complicated passwords. Blockchain technology is also a fantastic problem-solver for cyber-security.