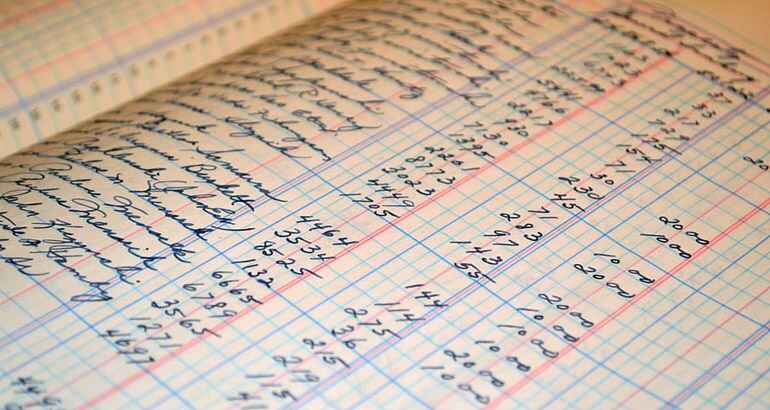

Keeping a continuous track of all the business transactions can be a tedious job. However, the non-maintenance of such transactions will lead to a difference in the business calculations and relevant proceedings. These business calculations are important for the management to decide the future path for the business. The business owners and entrepreneurs prefer the […]

How to Maintain Business Books (Accounting Records)?

The business records are a vital element that plays a significant role in leveraging the growth opportunities for an entity. Proper tracking of business growth and to understand the profits and losses that occurred during a specific period of the business is the main goal behind maintaining business books. It is important to note that […]

How Technology Transformed Accounting?

The invention and growth of technology have brought a massive change to the business world, infusing itself to every possible domain. Over a period of time, the usage and utilization of technology have been implemented in different areas like accounting, audit, tax, etc. Specific software is available in the global market for the business entities […]

How Can DMCC Auditors Help in Audit and Business Planning?

Over the past few years, there has been a massive increase in the growth of business entities in the region of Dubai. Holding the flexibility of providing a perfect investment ground, the government has taken multiple strategies to ease the business setup process in the area of the UAE. Now, as per the stated guidelines, […]

Anatomy of Related Parties in a Tax Group

A business entity is entitled to pay tax at the end of the financial year. The region of UAE has implemented the concept of VAT on 1st Jan 2018, wherein the business entities are entitled to pay the VAT at 5 percent. Now, many at times it becomes difficult for the business entities to cope up […]

Why is Accounting an Important Function – Especially for Small Businesses

The term Accounting will be known to all the businessmen and entrepreneurs. It is one of the most basic function which a business needs to perform. Accounting not only helps the day to day business activities but also assist in service which will be performed in the future. Every business needs to maintain its books […]

Outsourced Accounting: How can it Benefit your Business?

The process of Accounting can be very monotonous and tedious work. Still, in the present world scenario, it is one of the most critical functions which a business needs to perform to ensure its survival. A business needs to keep a close eye on the expenditure made by the company, and the function of accounting […]

IFRS and GAAP – What is the difference?

There has been a visible increase in the number of businesses all over the world. The United Arab Emirates is no stranger to the gradual rise in the businesses coming into the country. All the businesses are required to adhere to certain accounting standards while preparing the necessary financial documents of the company. There are […]

All you need to know before Choosing a VAT Return Filing Consultant

The implementation of the Value Added Tax in the United Arab Emirates is a reasonably new change, and this change was made to help both the public as well as the business entities. Not only will the VAT reduce the dependency of the country on the oil and hydrocarbon sector, but it will also simplify […]

Books of Accounts to be Maintained in the UAE

When a person in business or entrepreneur sets up a company, the primary aim of the person is to generate profits for himself and the stakeholders. It is easier for a business entity to find out if it is gaining profits or is facing losses by maintaining the books of accounts of the company. These […]