Benefits of Hiring an Auditing Firm in Abu Dhabi

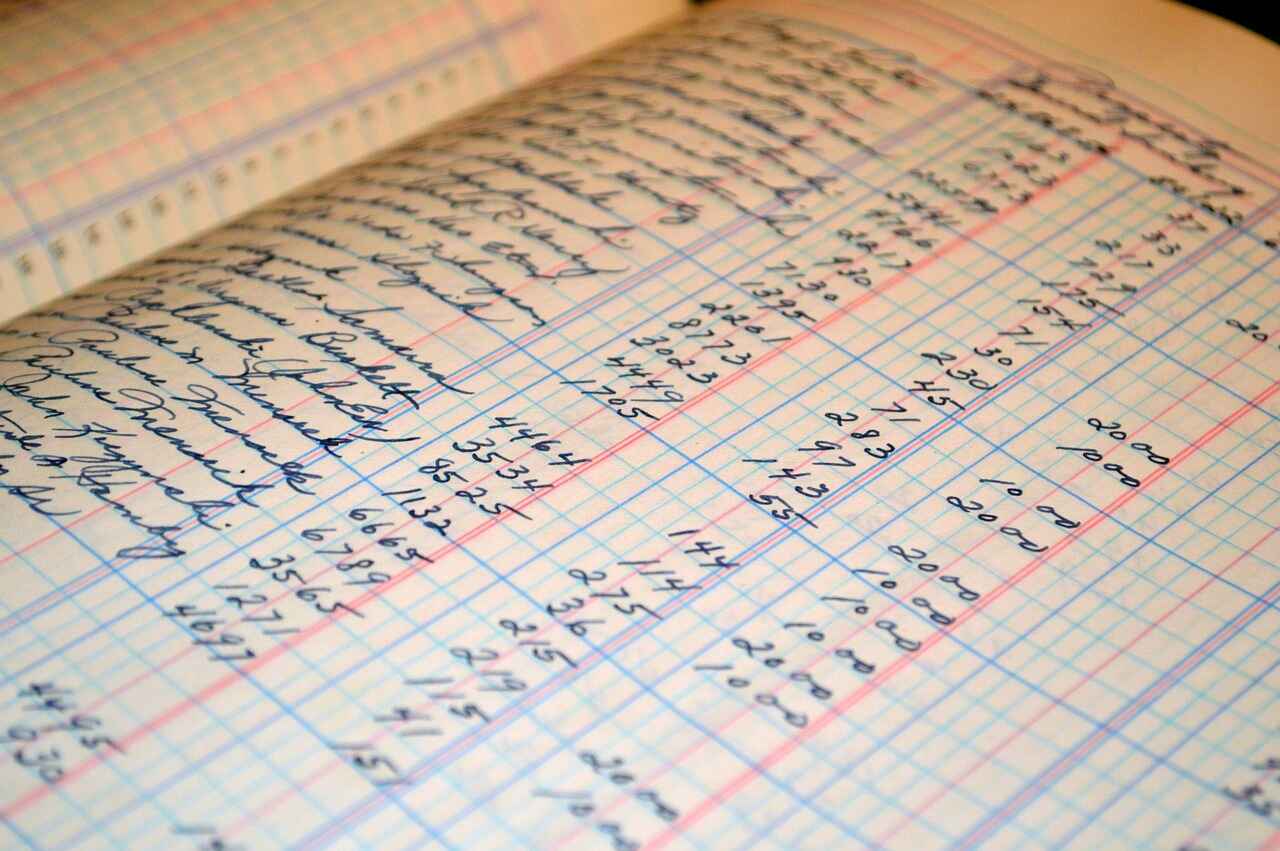

Auditing firms in Abu Dhabi with professional experience is important for all types and sizes of businesses. These firms provide exceptional financial reports and tax advice and also make all important decisions related to the company. Indetifinding and holding hands...