Dubai is known as a global business hub and here new entrepreneurs, business people and investors are giving all they have got to achieve a thriving business in the heart of the desert. Amid the towering business landscape, some unsung heroes play their role silently and are behind almost every business’s success – the Chartered […]

Dubai’s Financial Symphony: Harmonising Success with the Best Audit Firms in Dubai

An audit firm plays a major role in any company’s success. That will help you understand the financial situation of your business. Choosing the firm that is required by your business among the best audit firms in Dubai can be a challenging task but very much necessary to ensure the future of your business. This […]

Audit Firms in Sharjah

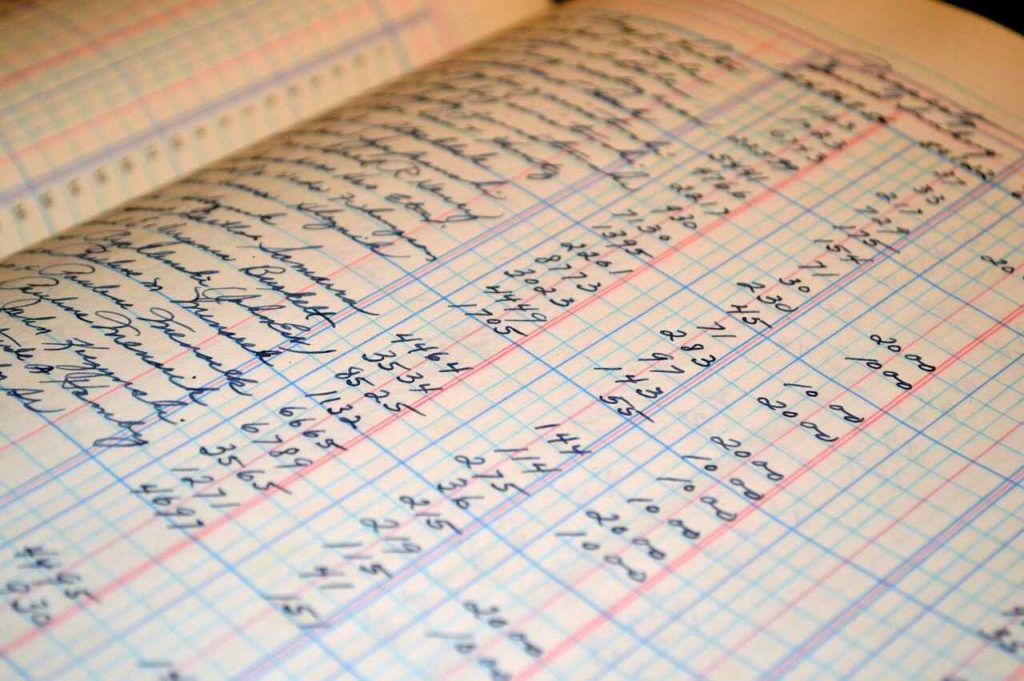

If you have ever been in the accounting field, the word ‘auditing’ might not seem very strange. But what is auditing? In simple words, Auditing is simply the double-checking and verifying books of accounts and recorded financial data prepared by the accountant in an organisation. It is done against the source documents from which they […]

Benefits of Hiring an Auditing Firm in Abu Dhabi

Auditing firms in Abu Dhabi with professional experience is important for all types and sizes of businesses. These firms provide exceptional financial reports and tax advice and also make all important decisions related to the company. Indetifinding and holding hands with the best auditing firm in Abu Dhabi is a huge task. So here is […]

Best Accounting Firms in Dubai

Accounting firms in Dubai can assist you in keeping your finances in order, help your company keep all your transactions on track, and ensure tax compliance. Finding the best accounting firm will have a direct impact on the success of your business. If you are someone who is searching for the best firms, you are […]

Best Accounting services in Dubai

The best accounting services in Dubai should understand your long-term goals and your business needs. Considering all these, here we are, JAXA Chartered Accountants, amongst the top accounting service providers and most prominent accounting firms in Dubai. We cover all the technical aspects as per the International Financial Reporting Standards; this fact again makes us […]

Top Auditing Firms in Dubai

Audit firms in Dubai play a major role in the success of any business. It’s mandatory for a business to maintain its accounts and strong financial control. Hiring the best audit firms in Dubai that provides qualified auditors will help you in understanding the financial position of your company. There are many audit companies in […]

Business Accounting Services in UAE – A Complete Guide

Do you know how accurate your accounting and financial statements are? Are you sure your accounting practices are adhering to the UAE legalities? Before knowing about the best practices, you should be aware of the consequences improper accounting. Poor accounting can cause hefty penalties and, in worse cases, even suspension of your business license. How […]

Benefits of Hiring the Best Auditing Firm in Dubai

Dubai is one of the best places to start a business. The liberal government and the efforts taken by the government made Dubai a business-friendly place with extraordinarily built modern and high-tech infrastructure. Doing a business setup in Dubai is a straightforward process, but entrepreneurs face hurdles when it comes to auditing. Every second counts […]

What Are the Benefits of Outsourcing Accounting Services in Dubai?

Business setup is not that hard in today’s business world, but companies slip when it comes to accounting. For managing the accounts, you always have two options: doing it by yourself and when it comes to doing it within the company by hiring an accountant. You should take care of the eligibility, qualifications, experience, and […]